Pat Gelsinger\’s sudden departure has paved the way for the struggling company to explore potential deal options, including those that the former CEO had previously dismissed during his tenure.

San Francisco, US:

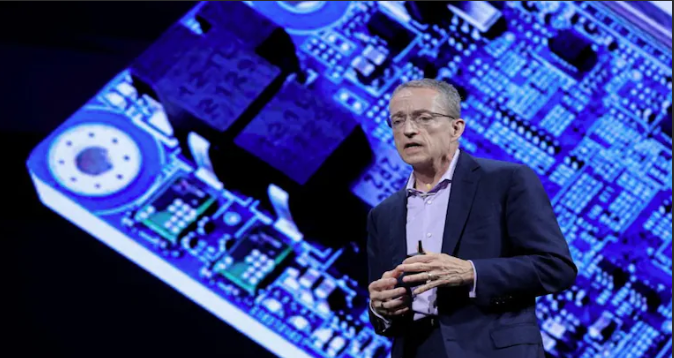

After less than four years as CEO, Pat Gelsinger resigned from Intel on Monday under pressure from the board. Sources told Reuters that during a recent board meeting, directors concluded that Gelsinger\’s costly and ambitious strategy to revitalize Intel wasn\’t delivering the expected results quickly enough. The board gave him the option to retire or be removed, and he chose to step down.

Intel’s communications chief, Karen Kahn, is also reportedly planning to leave the company.

With Gelsinger\’s departure, Intel has appointed two executives, CFO David Zinsner and former client computing head Michelle Johnston Holthaus, to temporarily lead the company as it searches for a permanent replacement. This leadership change comes just days after U.S. officials approved $7.86 billion in subsidies for Intel.

Pat Gelsinger’s Time At Intel

When Pat Gelsinger took over Intel in 2021, he inherited a company facing significant challenges, which he ultimately exacerbated. With ambitious goals for manufacturing and AI capabilities aimed at major clients, Intel under his leadership lost or cancelled key contracts and failed to deliver on its promises, as highlighted in a Reuters special report from October.

Pat Gelsinger made overly optimistic predictions about potential AI chip deals, surpassing Intel\’s own projections, which led the company to revise its recent revenue forecast about a month ago. Under his leadership, Intel, once the cornerstone of Silicon Valley\’s global chip dominance since its founding in 1968, has seen its market value shrink to less than a third of Nvidia’s, the leader in AI chips.

During his tenure, Intel’s stock dropped 0.5%, with the company reportedly losing more than half of its value this year. Last month, Nvidia replaced Intel in the prestigious Dow Jones Industrial Average index. Meanwhile, competitors like Advanced Micro Devices saw their shares rise by 3.6%, and the PHLX Semiconductor Index gained 2.6%.

Gelsinger’s departure comes long before the completion of his four-year plan to restore Intel’s leadership in producing the fastest and smallest computer chips, a position it lost to Taiwan Semiconductor Manufacturing Co., which manufactures chips for Intel’s competitors like Nvidia.

What’s Next For Intel

Pat Gelsinger’s sudden departure has opened the door for Intel to explore various strategic options, including some that he had previously rejected during his time as CEO.

According to a Bloomberg report, the board has been discussing various possibilities in recent months, such as private equity deals or even splitting Intel’s factory operations and product design divisions. Gelsinger had been opposed to breaking up the company, instead focusing on his vision of restoring Intel’s technological leadership and becoming a manufacturer for external clients. With his departure, the conversation is now open to new possibilities.

The report also notes that investment firms Morgan Stanley and Goldman Sachs Group Inc. have been advising Intel on its options and may find a more receptive audience with the new management. This shift in leadership could also encourage potential buyers to reconsider acquisition opportunities for some or all of Intel’s business. Bloomberg has reported that Qualcomm Inc. had previously shown interest in a deal, though discussions did not progress far.

Pingback: Intel has quietly begun accepting preorders for its new - Tech Behinds